More UK Businesses Are Falling Victim To Click Fraud

The Rise of Click Fraud & What It Means To Your Business

Learn How You Can Prevent It Happening To You

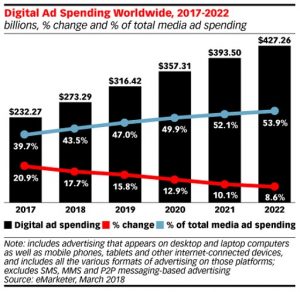

The last decade has seen the biggest marketing revolution in history, with online advertising helping bridge the gap between businesses and their customers. As a result traditional advertising like print have seen a dramatic decline across the UK year on year, while digital ads is now the number 1 marketing channel dominating businesses marketing budgets.

PPC (pay-per-click) advertising is one of the most measurable & scalable data-driven advertising methods, with its ability to target audiences based on their demographic, location, gender and intent to purchase. With Googles value in the billions, it has unsurprisingly attracted an increasing number of fraudsters to the industry. In 2017, about 1 in 5 clicks on adverts were fraudulent, with the number slowly increasing every month.*

What Is Click Fraud?

Click fraud is the fraudulent clicking of pay per click adverts to generate fraudulent charges for advertisers. It can either be from bots, competitors, disgruntled customers or click farms all with the objective of sabotaging businesses online performance by depleting their budgets and driving up advertising costs.

When it comes to the future of a business, many crucial decisions are determined by data. Click fraud can significantly skew analytical data and campaigns that are the lifeblood and result of 50% or more of clients, may appear to be noticeably less profitable.

According to Bloomberg, fake traffic has become a commodity**. There’s malware for generating it and brokers who sell it. Fortunately, it has given rise to an industry of countermeasures.

How to eliminate Click Fraud?

Google’s algorithm at times can recognise fraudulent behaviour and will provide credit to accounts. However it may not feel enough and many business owners and marketing directors are taking control by going the extra mile.

Here are a few tips to protect yourself from click-happy fraudsters:

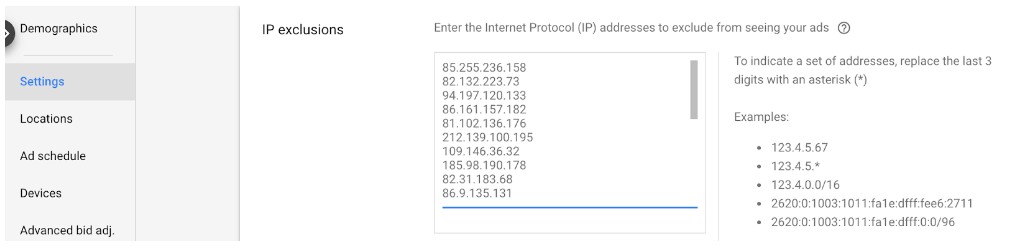

- Manually Set Up IP Exclusions in Google Ads: identify the IP addresses of competitors and add them to the IP exclusion list. To set up an exclusion, go into a campaign and click into the Settings tab > Additional Settings > IP Exclusions. Add the fraudsters IP addresses and click save.

- Create Remarketing Campaigns: To help avoid publisher-based click fraud, remarketing ads display to audiences whom have already visited your site and expressed an interest.

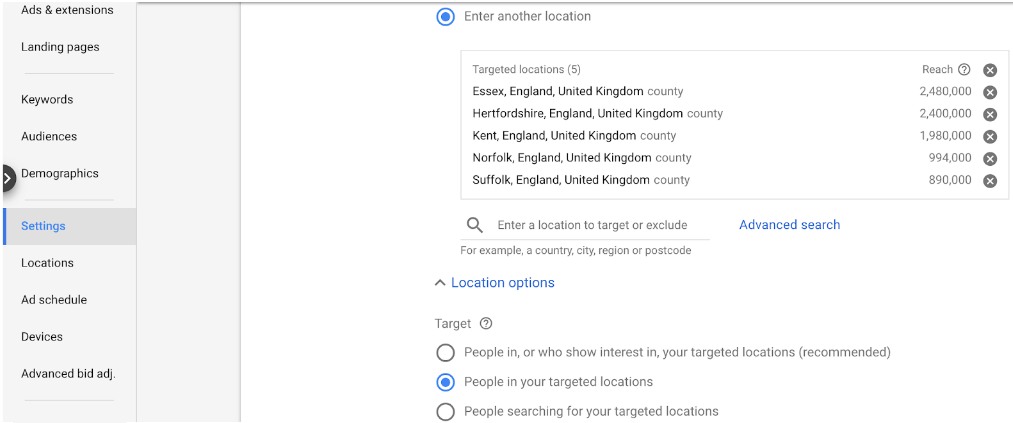

- Adjust Your Location Targeting: It is common for ads to appear outside the locations specified on Google & Bing. If there are noticeable clicks from geographic regions, typically poorer countries that are not relevant, then it is worth updating location targeting. To check, click into Settings tab > Locations > Location Options > Choose “People in your targeted locations”.

- Get Click Guardian: Click fraud prevention software helps businesses save 20% of their marketing budgets on average. Click Guardian are the UK’s Number One Google Ads Anti-Click Fraud Protection Service. They identify bots, competitors and click farms IP addresses while analysing audience behaviour, location and devices used. If clicks are fraudulent, the fraudsters IP address are automatically updated to the exclusion list, stopping wasted spend. For businesses running Google Ads and Bing, it is incredibly useful and very good value. Even better is that they offer a 14 day free trial.