How IVA’s are helping Brits stay protected from spiraling aggressive debt collection tactics

What is an IVA?

(Individual Voluntary Arrangement) Iva’s were first introduced by the government in 1986 and must be setup by a registered Insolvancy Practitioner (IP). It is a legally binding agreement between you and your creditors. The arrangement will stop any further interest and charges being added your debt. (Creditors can’t change their mind!) and normally lasts 60 months, During this period you will be expected to make one affordable payment each month towards your debt. At the end of 5 years* what ever debt remains will be legally written off.

- Debt charity Step Change produces worrying survey into aggressive debt collection in UK

- 1,800 struggling people share stories of intimidation and threatening behaviour

- 26% state that debt collectors “forced” them to make repayments they could not afford

- Speculation that increasing levels of aggression and harassment are persuading consumers to take shelter in Individual Voluntary Arrangements

The state of aggressive debt collection in Britain

Leading debt charity StepChange has produced a damning report on the state of the UK’s debt collection market, stating that “poor and inconsistent treatment of those struggling with debt is making many people’s financial problems worse”.

Martin Lewis, founder of MoneySavingExpert who backs StepChange’s campaign, complains that creditors and debt collectors are “piling on charges and pressure”. Mr Lewis believes that more help needs to be made available to those struggling with mounting debt, unaffordable high interest rates and heavy-handed collection procedures.

Leading IVA firm, National Debt Help, has urged consumers with more than £5,000 worth of debt where repayment is a struggle to consider taking out an individual voluntary arrangement to stop door-step and telephone debt collector harassment.

In a statement, the IVA specialists stated “under an IVA, the debtor is protected. Lenders can’t hammer the consumer with door step visits and constantly pressure them to settle debts over the telephone. Everyone deserves peace in their own home.”

Debtor “anxiety and stress”

StepChange’s report into current UK consumer debt collection involved deep consultation with 1,800 people currently being targeted by companies they owe money to. Many of these companies have sold the debt onto third parties who often buy the debt for pennies in the pound.

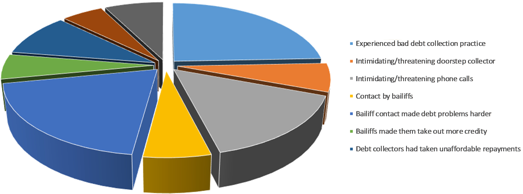

65% of the respondents reported that they’ve been on the end of bad debt collection practice in the last two years. Of particular concern was the nearly one fifth of people who stated that they had found a doorstep collector visit “intimidating” or “threatening”. In addition, over two fifths had been harassed on the phone at home.

Worse still, 16% had been contacted by bailiffs. From those, more than half said that dealing with bailiffs on top of the debt issue had made the whole situation harder to cope with. Just under a fifth felt forced to take out more credit to stop the bailiffs from coming.

Pressure to hand over money

Individuals and families under financial pressure are forced to budget to buy life essentials, like food and clothing. On top of that, there are monthly expenses which can’t be put back like council tax, TV licensing and utilities.

26% of respondents reported that debt collectors had taken repayments from them that they couldn’t afford. This caused even greater problems with budgeting.

14% told StepChange that creditors had deducted repayments directly from their wages or benefits, and that those deductions were unaffordable.

The protection of individual voluntary arrangements

National Debt Help, a firm which points struggling consumers to IVA practitioners, welcomed the news that more and more consumers were choosing individual voluntary arrangements than attempting to pay down unaffordable debts.

In a statement, the company said that “for many individuals and families, it takes the pressure off. It’s great that IVAs get debt down by up to 85%. Also, under an IVA, you make one payment a month of a fixed amount to just the one account, your IVA practitioner.

“For us, it’s the sense that we’ve helped someone lift the weight of the world from their shoulders that makes our jobs the best on the planet. The harassment ends. All charges and interest are frozen. No more bailiffs. No more calls during the middle of dinner asking for money you don’t have. For anyone with unaffordable debts totalling more than £5,000, you can stop all the trouble and intimidation for £80 a month.”

Is an IVA right for you? Check If You Qualify Now For Free.

To get started choose how much you owe