Thousands turning to a pre-paid Funeral Plan to avoid rising funeral costs

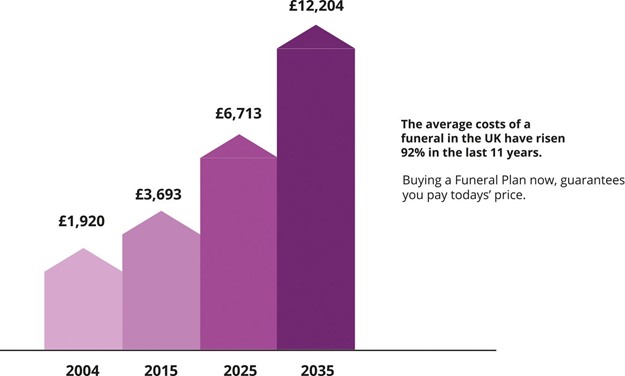

Funeral costs are rising at a rate of around 6% a year, to put that into perspective that’s higher than commodities like electricity and gas. The cost of funerals are predicted to keep on rising for the next 15-20 years. The expected cost of a funeral in 2035 is expected to be more than £12,000.

The reason for the rising costs of funerals is largely due to the laws of economics supply and demand. Due to the baby boom after the war, the percentage of the population over 60 is 25% and this is expected to rise to over 29% in 2035. With life expectancy increasing due to improvements in medicine and health care, the amount of people aged over 60 in 2030 is expected to be more than 20 million. This, therefore, means there is more demand for funeral directors than there is supply, as it’s a very specialised industry to get into, consequently this means that funeral directors can put their price up year on year. With rising operating costs like fuel and minimum wage, funerals are increasing at a higher rate than inflation.

People are combatting the rise in funeral costs by taking out a pre-paid Funeral Plan. A Funeral Plan means that you fix the cost of your funeral at today’s prices, regardless of how much they increase by over your lifetime.

Mrs Taylor described how her mother took out a Plan over 5 years ago and paid £1500 for the pre-paid Funeral Plan, which was the cost at the time.

“My mother took out a pre-paid Funeral Plan over 5 years ago, when she passed away at the end of last year I activated the Plan as per her wishes. I was expecting to be asked for extra money as I had helped a close friend arrange a funeral a couple of months before and was aware the cost was over £5000. I was shocked that the Plan that my mother had covered everything, and I was not asked for an additional penny. I think my mother’s thinking behind taking out a Funeral Plan wasn’t necessarily about the rising cost but was thinking that she didn’t want arguments in the family over who would initially pay for the funeral.” – Get a quote in 30 seconds today

A Plan to Suit You

Funeral Plans are an affordable and convenient way to also arrange funeral essentials as well as avoiding rising costs. There are also payment options to suit budgets and no medical or restrictions. In a recent report, 95% of those organising a funeral said it was much easier if they knew the deceased wishes.

It’s quite simple activating the Plan, in most cases the funeral planning company provide a telephone line that can be called at point of activation, at that point the funeral planning company take over while keeping in touch with the next of kin. They contact funeral directors, arrange any costs that have to be paid and liaise with the funeral director and next of kin regards any additional wishes that have been requested.

A recommendation to customers is to use an independent Funeral Plan provider so you are not tied to a specific funeral director which can cause issues further down the line, if they close or you re-locate. By using an independent company, they work UK wide with the already established funeral directors so there will always be a local one which helps you to know that family won’t have the added stress of having to travel for miles and miles to a funeral director.

Life insurance can provide an alternative to a funeral plan and provides a lump sum payment on death, however with the rising costs of funerals the lump sum payment in most cases may not cover the cost of the funeral leaving relatives with a hefty bill.

As funeral planning is becoming a highly competitive industry, comparison sites such as www.myfuneralplansupermarket.co.uk have been set up to search the market and provide the best possible packages. These sites offer exclusive discounts due to the volume of business they provide, in the same way comparison sites offer deals on car insurance or home insurance.

Start today and compare funeral plan prices in just 30 seconds